ProximaX 1st. Quarter, 2019 – Review by Lon Wong

ProximaX has seen yet another quarter of rapid growth across all fronts. In this update, I will share the latest report on our infrastructure platform progress, vertical application solutions, business development, and some of our corporate plans.

Infrastructure platform progress

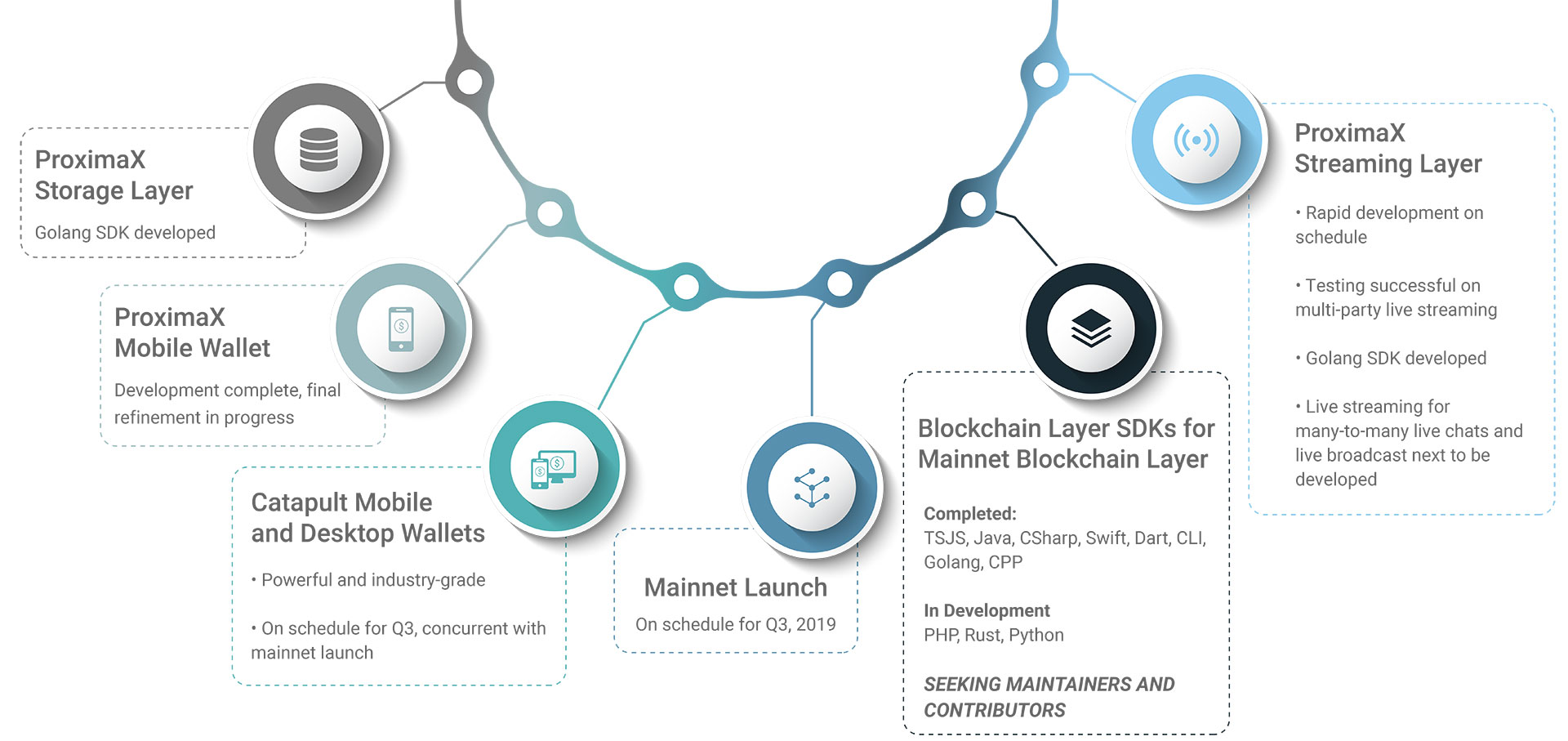

The public mainnet is coming along well and we are looking very much to be on schedule. At the time of this writing, we have finished developing a completely revamped new mobile wallet. We plan on launching it soon, pending further refinement and bug fixing. We have also developed an industry grade mobile wallet based on the latest Catapult release. Upon the rollout of the ProximaX mainnet, we should see a concurrent release of the Catapult mobile and desktop wallets. The desktop wallet shall be very much enhanced, taking into consideration the integration of the streaming and storage layers that are part of the ProximaX solution offering.

We are continuing to develop heavily on the ProximaX streaming layer and I am pleased to report that we are also progressing to schedule on that front. The streaming layer has been tested to work well on our platform and allows for live streaming between parties. Our next component is to work on live streaming from many-to-many, where users can carry out live chats, including live broadcasts. As of now, the SDK for the streaming layer is based on the Golang programming language.

The development of the ProximaX Sirius platform follows two concurrent paths. One is the mainnet, and the other is the private net where solutions are constantly being added on whilst the mainnet is being developed. The mainnet requires extensive design of the consensus mechanism and tokenomics before applications can be added onto it, and more importantly, they must be functioning. The team is working concurrently on the application development on the private net and development of the mainnet, so that when the mainnet is finally completed, we will have some applications that can run on it immediately. These applications that we develop are proof cases so as to give potential application developers an idea of how solutions can be developed on the ProximaX Sirius platform.

In tandem with the preparation to launch the mainnet, we have basically completed a suit of SDKs for the blockchain component. These are:

• TSJS – tsjs-xpx-catapult-sdk (Typescript/Javascript)

• Java – java-xpx-catapult-sdk (Java)

• CSharp – csharp-xpx-catapult-sdk (C#)

• Swift – swift-xpx-catapult-sdk (Swift)

• Dart – dart-xpx-catapult-sdk (Dart)

• CLI – catapult-cli

• Golang – go-xpx-catapult-sdk (Go)

• CPP – cpp-xpx-catapult-sdk (Cpp)

PHP- php-xpx-catapult-sdk, Rust – rust-xpx-catapult-sdk, and Python – python-xpx-catapult-sdk are still being completed. We plan on releasing these to the open as soon as possible and are actively seeking maintainers and contributors to come on-board which will enable us to do so. Engaging maintainers is imperative for us to be able to coordinate well with the heavy responsibilities ahead. We are also looking at developing an SDK for PonyLang. However, this is not high on our priority list.

As for the other components, namely, the streaming and distributed file management core components, we have developed the Golang SDKs. These are:

• go-xpx-psp-sdk (Golang SDK for streaming)

• go-xpx-dfms-sdk (Golang SDK for storage)

We plan to focus more on developing the SDKs for the other languages for the storage and streaming layers as we plod along. We are proud that we have accomplished quite a lot in this massive undertaking, and in such a short period of time. With this completion, we are also proud to say that we are the most comprehensive provider of the NEM Catapult and the only ones in the Catapult space offering a full production environment with a support system in place via our ProximaX Sirius platform. More importantly, the SDKs are a realisation of the agglomeration of technologies that ProximaX had set out to do.

Rolling out such a huge project requires service readiness, and the need to be executed with precision and planning. To that effect, we have been introducing new infrastructure/devops technology into our infrastructure team. These include application automation technology, deployment, and provisioning orchestration.

We use a continuous integration process to create systematic builds to test our nodes, and the SDKs. All server-code (nodes) are dockerised which makes it easy to deploy in all environments – whether in development, testing, staging, or production mode. This same docker orchestration will be used for provisioning nodes on well-known cloud service providers. As a matter of fact, we are in the advanced stages of negotiations with these top cloud service providers to ensure that we can do large scale deployments when it comes to mainnet or private net.

On the support front, we have the same infrastructure team handling all customer/client requests for access. These include provisioning private instances, demo environments, VPN access grants, and application/web deployments. Furthermore, the infrastructure team is also providing services to the technology team that handles the Jira Support Service Request – where our business development team requests access credentials on behalf of their clients.

All these tools are initiated and carried out by our formidable infrastructure team that has been put in place. Processes are streamlined and are continually perfected so that we can achieve our objective of making sure we can deliver and deploy our solutions very quickly.

Vertical application solutions

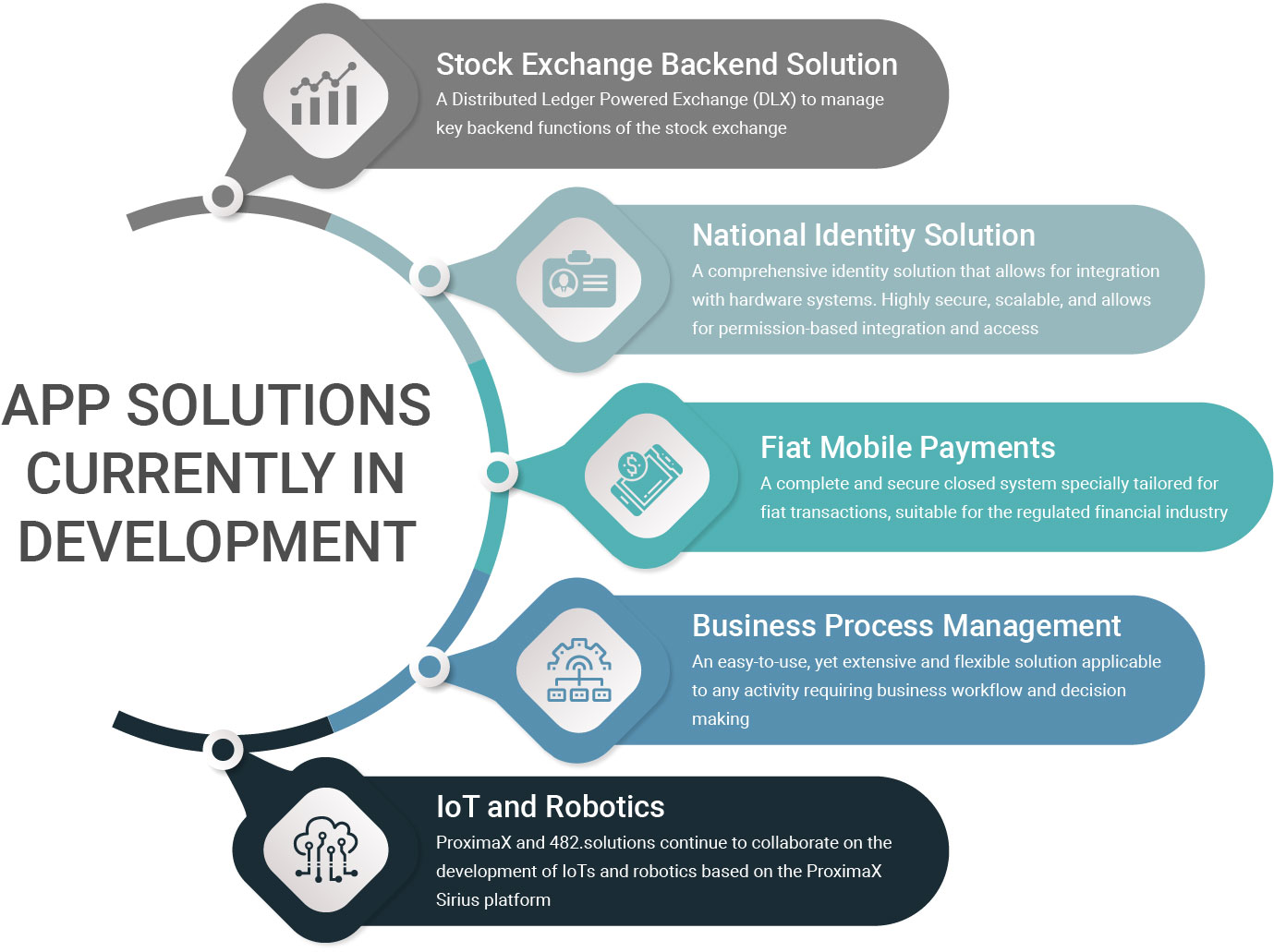

Aside from progress on the ProximaX Sirius infrastructure platform, a number of new vertical applications are being built on the platform, either by ourselves or by our partners. These vertical applications include a stock exchange back-end solution, national identity PoC, mobile payments for fiat and a business process management solution. I shall go through each below.

In 2014, I had conceived of the idea of T+0 – almost zero lag time for payment settlement – for the traditional equity market powered by blockchain, alongside a front-end trade matching engine (i.e., a stock exchange core engine). Subsequently, I had the concept paper for this released in April 2017, titled “Radicalizing the equity market landscape”. This solution is now being built and turned into a reality on the ProximaX Sirius platform.

Codenamed DLX – for Distributed Ledger powered eXchange, the objective is to manage key backend functions of a traditional stock exchange on the ProximaX Sirius platform, including payments, settlement, company registrar, KYC, etc. In essence, there will be a recording system that will record all equity movements and transactions which are completed offline and at the front-end stock exchange. A blockchain powered platform will allow these back-end functions to be synchronised in real-time. DLX is designed to ensure that transactions could be ingested at the rate of 1,000 transactions per second at a minimum. Although the blockchain is capable of ingesting a higher transaction rate, this number was chosen because it allowed for an optimum transaction success rate that is sustainable, reasonable, and practical. Every trade must be recorded from the matching engine according to the occurrence of the trade match and exactly in that order. Every trade that is matched must be signed, approved, and countersigned before being broadcasted into the blockchain. This differs from straight-through transactions (without signing and processing), which when tested, proved to be near 10K tps in a lab condition.

The DLX initial design has been tested to operate satisfactorily and the team is close to completing its first version. Upon completion of this, ProximaX Sirius will be among the first infrastructure platforms in the world to power a Stock Exchange and by that extension, a Security Token Exchange. Our ProximaX KYC application is part of this solution, and provides the necessary tools to run a proper exchange. This solution marks a milestone in the development of a blockchain powered trade exchange platform, where now, a lot more can be done. Not only will the solution enable T+0, it can also disburse dividends, issue new shares, and allow for offline transactions involving substantial shareholder disposals, mergers, and acquisitions. In addition to substantial cost savings, trades will be made more efficient and fast through this new approach to equity trading. Regulatory requirements is also expected to be substantially reduced, making it much simpler for regulators to manage stock trading activities. Stock movements are near real-time, giving regulators a new way of monitoring irregular activities in real-time. Many intermediaries are removed, including, traditional custodians, settlement systems, clearing houses, brokers and other support services that traditionally form the equity market ecosystem. Consequently, many of the regulatory requirements of these players will be removed as their functions become obsolete.

A comprehensive identity solution PoC is being completed, useful for national ID implementation – an extension of our KYC solution. It allows for integration with any hardware systems such as card readers with physical cards so that IDs are not only recorded in a secure, distributed, and encrypted repository platform, but also gives the full function and use of a national ID system. Further, it is highly scalable to allow for many more applications to ride on this identity solution. It is an open platform that allows for permission-based integration and access to the system.

A comprehensive mobile payment system was being developed in the first quarter. This is based on the Catapult solution and is specifically tailored for fiat money transactions. The solution includes management and distribution of fiat money through physical cash dispensers for top-ups, remittance of money, and a merchant point of sale solution. Additionally, this solution is a closed system, meaning all money flows among users are confined within the ecosystem. It cannot be sent out to a random wallet holder, even if that wallet is a trojan wallet attempting to bridge the system. Every account is controlled and countersigned for every transaction. Every wallet must be registered in order to participate or use the system. Hence, it is a comprehensive solution that befits a regulated financial industry environment.

Towards the end of the first quarter, another vertical application solution is being initiated. This application is a Business Process Management (“BPM”) solution to be developed on the ProximaX Sirius platform. The first version should be completed soon. Almost everything we do requires some sort of business workflow and decision making. For example, applying for a permit with a town council, sale of a property, creating and executing a will, insurance, manufacturing, provenance, registrars, etc. This solution enables almost any process that needs a proper workflow with proofs and approvals, including the use of IoTs and feed-in oracles to complete the loop. The ProximaX Sirius platform provides all the backend infrastructure that is needed and therefore is another showcase of how applications and solutions can be easily developed. BPM is a complicated system solution, but we believe it will be made simple using the ProximaX Sirius platform. What excites us really, is not just the BPM as a solution, but it is how quickly it can be developed on the ProximaX Sirius platform. Fancy a product that can go out to market in 3 months! This is the ProximaX Sirius platform in its element.

ProximaX is working with 482.solutions from the Ukraine to further develop on IoTs and robotics based on the ProximaX Sirius platform. We have been closely collaborating with them on this domain. They have made great strides and are championing the use of our platform in every industry they are in. 482.solutions remain fully committed to developing the application front as well as contributing greatly to the core development based on our design and requirements.

Business development

In business development, apart from working with industries at large, we have been working with central and local governments to promote our solutions. Globally, we are in discussions with a number of large enterprise partners in financial services, inter-governmental organisations as well as SMEs. Going beyond our stronghold in Asia and emerging markets, we are actively working with and in discussions with partners in Australia and Europe. As with all things enterprise, the gestation period unfortunately, is slow.

We do not like to make announcements for announcement sake and are conscious of the commercial environment that we operate in. We will make announcements on business development when it is the right timing for all stakeholders without jeopardising anything commercial-in-confidence.

We are also developing new markets and exploring with System Integrators (SIs) and growing them so that the ProximaX Sirius platform can be used in many more environments and projects. Developing partnerships and training them shall be our primary focus with SIs.

Corporate plans

We moved to our new operational HQ in January this year. Located in Kuala Lumpur, the centre is big enough to house 60 seatings and conduct small workgroup events. The office is named ProximaX Accelerated Centre of Technology (“PACT”). The centre will be modeled like a work-space environment while concurrently, it is used to nurture start-up companies that are interested to jump-start their projects using the ProximaX Sirius platform and solutions.

We are undergoing a restructuring exercise with the aim of becoming a world leader in the next generation blockchain powered platform space. To that end, we are pleased to say that we are progressing well, especially with our intention to be a publicly listed entity, thus making ourselves as an enterprise class solution provider for the mainstream market.

The market is beginning to take notice that platforms like ProximaX Sirius are a reality now, and our presence in the market is rather comforting for both our project and end users alike, wanting to adopt the notion of using blockchain powered platforms. We hope to make a greater impact in the market in the second half of this year. As such, more effort will be put into marketing in the coming months.

In line with my goals, and considering that we are in existence for less than one year, I am proud that we are indeed progressing beyond what I had hoped for, and I am especially proud of my team who are ambitious and conscientious, and most importantly, delivering world class solutions in a timely manner. We are about 50 strong and growing globally. The team is highly motivated and focussed on what they know best. We have also the benefit of a generally supportive community that believe in us. We are indeed very excited on what is ahead of us!

Onwards and upwards!